Technical & Derivatives Report August 01, 2023

Sensex ( 66528) / Nifty (19754)

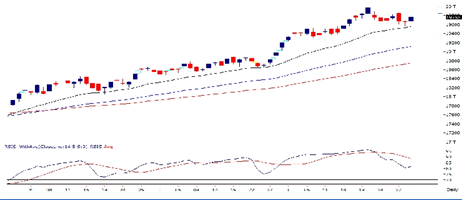

Our market started the day on a mild note, wherein the bulls firmly capitalized on the opportunity to push the market upwards. The benchmark index Nifty50 witnessed a modest rebound from the pivotal support and settled in green amidst some buying in heavyweights. Eventually, with the market breadth on the positive side, Nifty concluded the session on a positive note around 19750 with gains of over half a percent.

The sustainable movement in the key indices throughout the day construes a positive development. The bulls once again showed resilience to portray a buoyant undertone. As far as levels are concerned, 19600 is likely to act as a cushion, while the pivotal zone of 19500, coinciding with 20 DEMA, is expected to act as sacrosanct support. O n the higher end, a cluster of resistances can be seen around 19800 - 20000 in the comparable period.

The broad-based buying has levitated the sentiments of participants, but one should not become complacent and focus on a pragmatic approach to buy the decline and book on the rise. Also, one needs to stay abreast with the mentioned levels and follow the stock-centric strategy for better trading opportunities.

Key Levels

Support 1

– 19600 Resistance 1 – 19800

Support 2 – 19500 Resistance 2 – 19880

Nifty Bank Outlook ( 45651)

Bank Nifty had a positive start for the week, despite experiencing some minor intraday dips. The undertone remained positive, though the session was relatively subdued for this high beta index. By the end of the day,prices managed to gain about 0.40%, closing a tad above 45650

Observing the daily chart, there are no major negative developments following Thursday's sell-off, and prices are holding on to the crucial support of 20-EMA. Presently, this prominent heavyweight index is undergoing a consolidation phase and may likely continue.

in this pattern leading up to the RBI policy announcement next week. The support level to watch is around 45300 – 45200, while immediate resistance is anticipated between 46000 – 46300. For traders, a favourable strategy would involve buying during dips and taking profits at higher levels. A significant directional move is expected only upon a breakout from this range. Despite the relative quietness in the key indices, there has been noteworthy stock-specific action within this category. Traders are encouraged to identify potential performers that may provide opportunities to outperform key indices.

Key Levels

Support 1 – 45300 Resistance 1 – 46000

Support 2 – 45200 Resistance 2 – 46300

Comments

n The Indian equity market witnessed

buying interest post a flat opening

to rally beyond 19750. We concluded

the first session of the week on a positive

note with the gains of more than

half a percent.

n FIIs were net sellers in the cash

market segment to the tune of Rs. 701

crores. Simultaneously, in Index futures,

they sold worth Rs. 730 crores with a rise in

open interest, suggesting short formation.

n

On

the derivatives front, we witnessed

open interest addition in key indices

suggesting fresh long addition after last week’s profit booking.

On the options front, decent

piling of OI is seen at 19700 put strikes,

suggesting a nearby support zone. While on the higher end, decent unwinding was observed in 19600-19800 call strikes. The stronger hands continue

to sell equities and added shorts in index futures

segment. Considering the mentioned data, we

remain hopeful as long we manage to sustain above 19600

on the closing basis.

We shall not be in any way responsible for any loss or damage that may arise to any person fromany inadvertent error in the information contained in this report. We does not warrant the accuracy, adequacy or completeness of the service

The information in this document has been printed on the basis of publicly available information

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Post a Comment